BusinessESGESG Effect: Transforming Compliance to Competitive Advantage

In recent years, there has been a seismic shift in the way multi-national and publicly listed companies operate. Environmental, Social, and Governance (ESG) considerations have moved from the periphery to the core of corporate decision-making.

For businesses aspiring to collaborate with these industry giants, ESG compliance has transitioned from being a mere 'nice-to-have' to an absolute imperative.

Understanding ESG: A Brief Overview

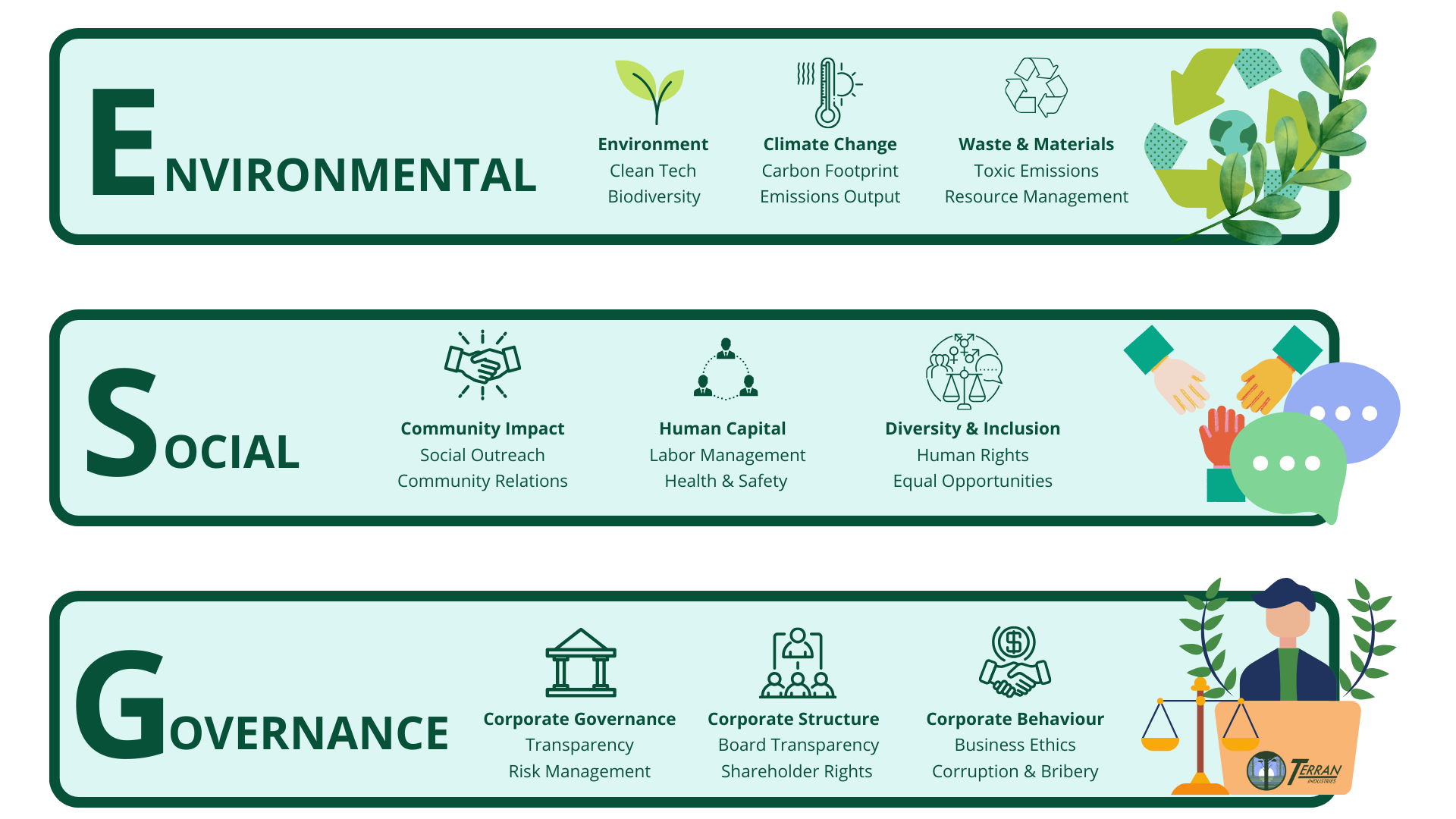

ESG stands for Environmental, Social, and Governance. These three pillars serve as a framework for evaluating a company's impact on the world around it:

Environmental

This encompasses a company's efforts to minimise its ecological footprint, reduce carbon emissions, conserve resources, and adopt sustainable practices.

Social

This relates to a company's relationships with its employees, suppliers, customers, and the communities in which it operates. It involves promoting diversity, ensuring fair labour practices, and contributing positively to society.

Governance

This focuses on a company's leadership, executive pay, audits, internal controls, and shareholder rights. Good governance ensures transparency, ethical decision-making, and accountability.

The Rising Tide of ESG Expectations

Several factors are driving the increased emphasis on ESG compliance among multi-national and publicly listed companies:

Stakeholder Demands

Shareholders, consumers, employees, and regulators are becoming more vocal in their expectations for companies to operate responsibly. There is a growing recognition that ESG factors can impact long-term sustainability and profitability.

Regulatory Pressure

Governments around the world are enacting stricter regulations related to environmental protection, social equity, and corporate governance. Non-compliance can result in hefty fines, reputational damage, and legal repercussions.

Risk Mitigation

Companies are recognising that ESG risks, such as supply chain disruptions, regulatory fines, and reputational harm, can have profound financial implications. By proactively addressing these risks, companies can safeguard their long-term viability.

The Competitive Advantage of ESG Compliance

For businesses seeking to secure contracts with multi-national and publicly listed companies, ESG compliance offers a distinct competitive advantage:

Enhanced Reputation

ESG-compliant businesses are viewed as responsible corporate citizens, thereby enhancing their brand reputation and credibility in the marketplace.

Access to Capital

ESG-focused investors, including pension funds, asset managers, and private equity firms, are increasingly prioritising investments in companies that demonstrate strong ESG performance. By aligning with ESG principles, businesses can access a broader pool of capital and favorable financing terms.

Strategic Partnerships

Multi-national and publicly listed companies are more likely to collaborate with suppliers, vendors, and partners that share their commitment to ESG principles. By demonstrating ESG compliance, businesses can forge stronger, more collaborative relationships with these industry leaders.

Future-Proofing Your Business Practices

In an increasingly interconnected and socially conscious world, ESG compliance is not just a fleeting trend but a fundamental shift in how businesses operate. By embracing ESG principles, businesses can future-proof their operations and position themselves for long-term success:

Innovation and Growth

ESG compliance fosters innovation by encouraging businesses to develop sustainable products, services, and business models. By aligning with emerging trends and consumer preferences, businesses can unlock new growth opportunities and gain a competitive edge.

Resilience and Adaptability

ESG-compliant businesses are better positioned to navigate evolving regulatory landscapes, mitigate risks, and respond proactively to emerging challenges. By integrating ESG considerations into their strategic planning and decision-making processes, businesses can build resilience and adaptability into their operations.

Stakeholder Engagement

ESG compliance enhances stakeholder trust by demonstrating a commitment to responsible business practices. By engaging effectively with shareholders, customers, employees, and communities, businesses can build stronger, more enduring relationships and create shared value for all stakeholders.

Conclusion

As multi-national and publicly listed companies face increasing pressure to meet ESG requirements and stakeholder demands, the importance of ESG compliance has never been greater.

For businesses seeking to collaborate with these industry leaders, ESG compliance offers a compelling pathway to unlock lucrative contracts, enhance reputation, and future-proof their operations.

By embracing ESG principles and integrating them into their business practices, businesses can position themselves for long-term success in an increasingly competitive and socially conscious marketplace.

Evannah Jayne

Founder & CEO

A passion for sustainability and a desire to change the world, Evannah seeks to raise awareness of the important issues surrounding our planet today.